When a pipe bursts or a bad storm hits, the resulting damage can be costly for homeowners. Accidental water damage can happen to anyone, anywhere, and at any time. Though it can occur without warning, being aware of maintenance issues early is critical to keeping potential water damage to a minimum.

Water damage can result in repair bills between $1,000 to $5,000 or higher, depending on the circumstances. A homeowners insurance policy can help fund cleanup, whether your property needs water extraction or complete restoration.

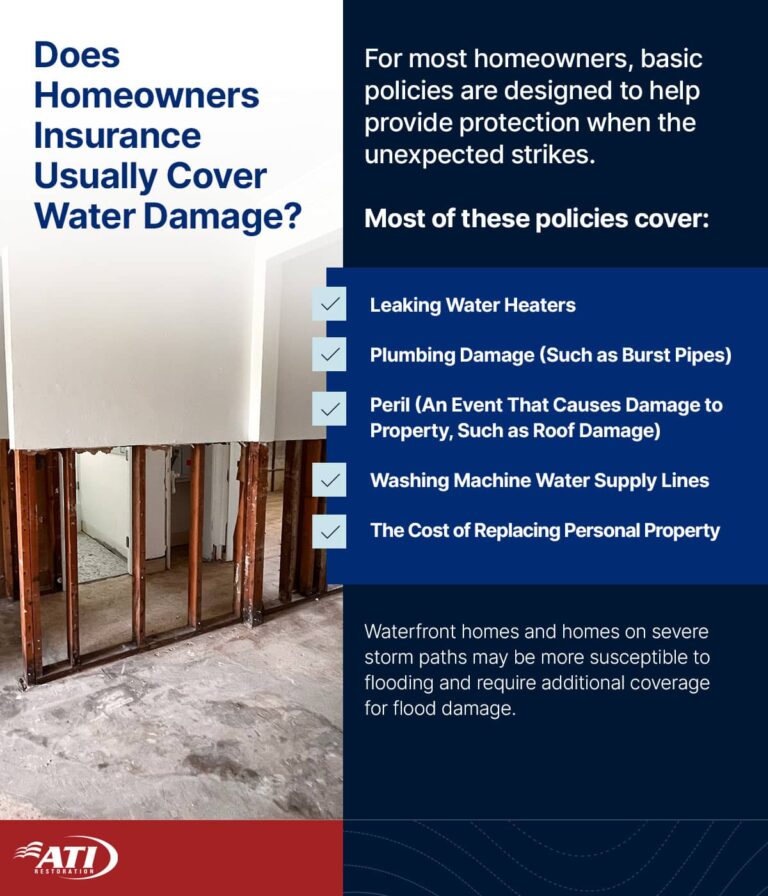

Waterfront homes and homes on severe storm paths may be more susceptible to flooding and require additional coverage for flood damage. For most homeowners, basic policies are designed to help provide protection when the unexpected strikes.

Most of these policies cover:

- Leaking water heaters

- Plumbing damage (such as burst pipes)

- Peril (an event that causes damage to property)

- Washing machine water supply lines

- The cost of replacing personal property

What Types of Water Damage Does Insurance Cover?

Plumbing Damage

Homeowners insurance and renters insurance may cover water damage if linked to a sudden or unexpected plumbing event, such as a burst pipe. Washing machine water supply lines often catch homeowners off guard, which is why it’s important to turn off the supply between uses or when you’re out of town.

If a slow water leak or lack of maintenance caused plumbing damage, it may not be covered by homeowners insurance. Because the costs to repair and restore often far exceed the price of basic maintenance on a plumbing system, it’s always best to contact a professional when you notice something going wrong.

Leaking Roof Damage

A homeowners insurance policy usually covers roof damage as a result of peril. Peril is understood as an unexpected event, and roof damage with subsequent water damage can occur suddenly during a windstorm or rainstorm, even when a roof is in good shape.

That said, roofing does tend to leak as shingles age, and an old, leak-prone roof does not always qualify for repairs under homeowners insurance. Insurance providers will identify if the damage qualifies as peril, or an unaddressed maintenance issue.

Appliance Malfunction or Overflow

Homeowners insurance claims related to appliances usually don’t cover repairs for the source of the water damage, but most policies will make it easier to restore affected areas of the home, such as damaged cabinetry, or floors.

Personal Property Damage

In addition to dwelling coverage, standard homeowners insurance policies also cover personal property destroyed by water damage. Coverage limits for damage can apply, but it can certainly help make it easier to repair and replace items that were unexpectedly damaged as a result.

What Types of Water Damage Will Insurance Not Cover?

Flood

Floods are among the most common natural disasters, but homeowners insurance doesn’t usually cover damage. If your home is situated near a rising tide, or a stream that tends to surge after a big storm, your insurance company may require you to carry flood insurance in addition to traditional homeowners insurance.

If your home is in a low-risk area but you want the added protection, you may want to consider a separate flood insurance policy. Your insurance company can help you learn more about pricing and eligibility to help you feel at ease in any circumstance.

Water or Sewage Backups

If a sewer or drain backs up into your home, the resulting mess can be unfathomable. Aging sewer systems, heavy rain storms, and tree roots can all contribute to water and sewage backups. While water backup coverage is available from insurance companies, many blockages are commonly caused by the homeowner and therefore are not covered by traditional policies.

Be mindful of what you dispose of down your drains (no paper products or grease). If a tree is near your sewer lines, consider having it monitored every few years. Most importantly, if you see any seepage that indicates a backup, contact a professional to assess the issue.

Poorly Maintained Pipes

Homeowners insurance coverage doesn’t typically cover damage associated with poor maintenance. Homeownership is a big responsibility in that regard. If you see that there’s a potential issue with a pipe or water source, get the maintenance you need before it becomes a problem.

Filing a Claim for Water Damage

Homeowners insurance policies can significantly reduce the financial burden of home repairs. If you need to file a water damage claim with your insurance company, there are a number of crucial steps to take:

- Mitigate the damage yourself, and be sure to contact the fire department and police if you have electrical concerns

- Call your insurance company to report the damage

- Photograph and video all damage

- Gather paperwork and electronic files related to damaged property (such as receipts and dates of purchase)

- Conduct an adjuster inspection; your insurer may recommend that ATI Restoration provides a detailed inspection to assess the damage and get insurance quotes

- Understand what your homeowners insurance policy covers, and how your deductible factors into your insurance claim.

- Ask questions if something is not clear.

Your insurance company agent will be your best contact when you’re trying to file a claim or understand your home insurance policy. When you’re aligned on what repairs will be funded by insurance, ATI Restoration can provide the water damage restoration and cleanup services you need.

Contact Us for Fast Water Damage Restoration Solutions

If you need assistance handling cleanup and repairs after experiencing water damage, the knowledgeable team at ATI Restoration will work directly with your insurance company to make the process easy.